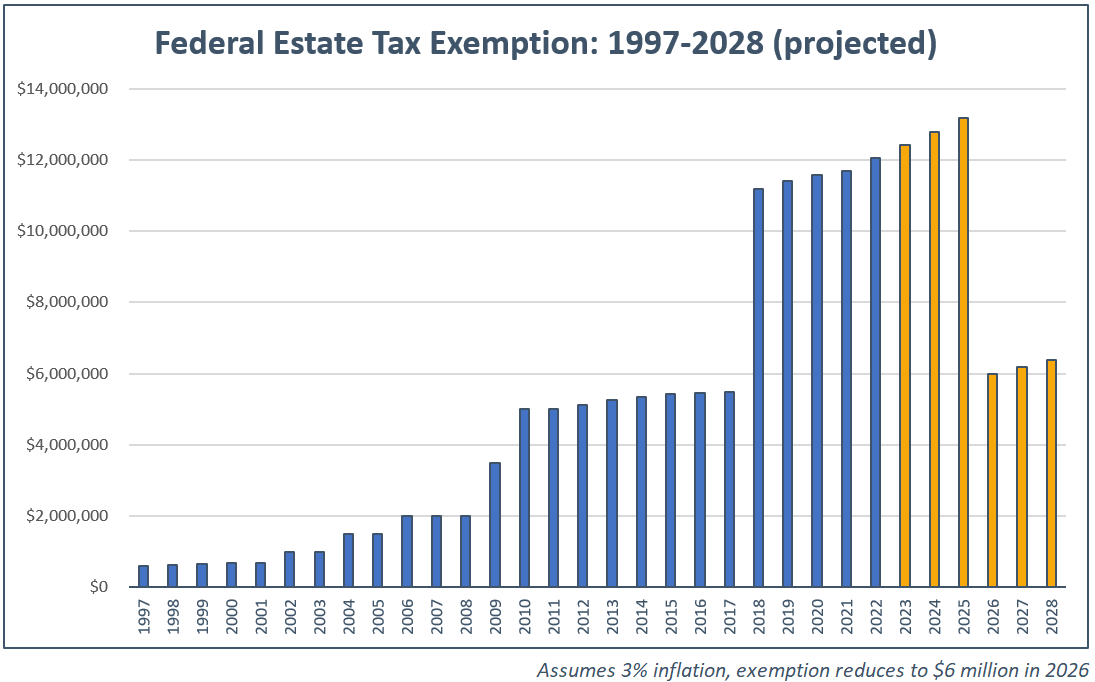

Federal Inheritance Tax 2025 - Estate and Inheritance Taxes by State, 2025, The federal lifetime estate and gift tax exemption will sunset after 2025. Historical Estate Tax Exemption Amounts And Tax Rates, Client ($27,980,000.00 for a u.s.

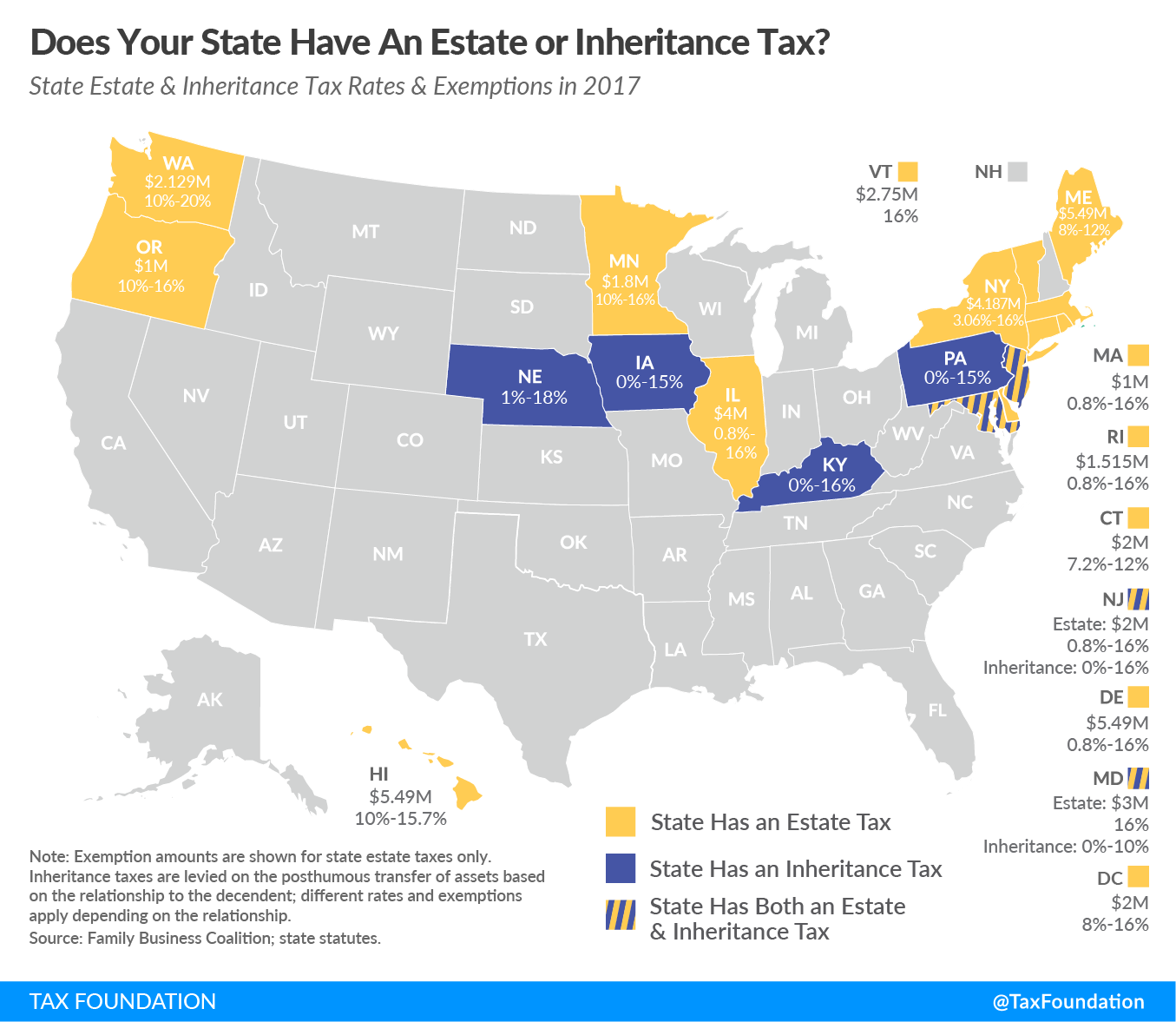

Estate and Inheritance Taxes by State, 2025, The federal lifetime estate and gift tax exemption will sunset after 2025.

2025 Federal Estate Tax Exemption Willy Julietta, The 37 percent tax rate will affect single taxpayers whose income exceeds $609,350 in 2025 ($626,350 in 2025) and married taxpayers filing jointly whose income exceeds.

Federal Inheritance Tax 2025. $13,990,000 in 2025) before the end of 2025. The irs announced a higher estate and gift tax exemption for 2025.

2023 State Estate Taxes and State Inheritance Taxes, In other words, giving more.

California Inheritance Tax 2025 2025, Several key provisions from the tax cuts and jobs act are slated to expire after 2025.

Federal Inheritance Tax 2025 Top FAQs of Tax Nov2025, The 37 percent tax rate will affect single taxpayers whose income exceeds $609,350 in 2025 ($626,350 in 2025) and married taxpayers filing jointly whose income exceeds.

Federal Estate Tax Exemption 2025 Making the Most of History’s Largest, The federal estate tax exemption is going up again for 2025.

The 37 percent tax rate will affect single taxpayers whose income exceeds $609,350 in 2025 ($626,350 in 2025) and married taxpayers filing jointly whose income exceeds. The congressional budget office estimates.

Federal Inheritance Tax 2025, The tcja is set to expire at the end of 2025.

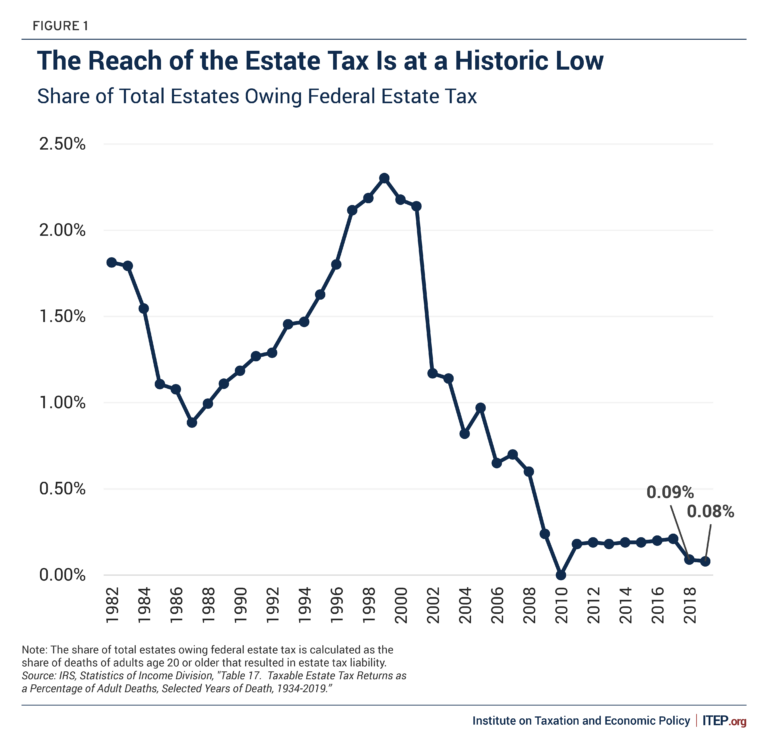

The Estate Tax is Irrelevant to More Than 99 Percent of Americans ITEP, The congressional budget office estimates.